If you own business property that needs repairs, you can benefit from speaking with commercial property damage lawyers who are on your side. We will negotiate with the insurance company for you, ensuring they do not take advantage of you. The commercial property damage attorneys at Burnett Law Firm are ready to assist you with your commercial property insurance claims. Schedule a free consultation today to learn more.

Understanding Commercial Property Insurance Claims in Texas

Purchasing the right commercial property insurance policies to protect your business interests is vital in the event of unexpected damage. The Texas Department of Insurance provides a wealth of information about insurance coverage available and recommended within the state. Typically, you will choose one or a combination of three kinds of insurance:

- Building coverage: Building coverage will repay policyholders for damage directly affecting their buildings on the commercial property. This includes the walls, ceilings, floors, HVAC equipment, and all permanently installed equipment.

- Business property coverage: This insurance will cover the fixtures, furniture, documents, inventory, equipment, and tools that do not fall under the building coverage.

- Personal property coverage: Any remaining items under the custody, care, or control of the commercial property owner fall under the personal property policy. Not every business owner needs this insurance since it depends on the nature of your company.

Individuals may choose to purchase additional insurance policies to specifically cover events such as flooding, earthquakes, wind and hail, crimes, and business interruption. Your insurance company will likely recommend you invest in as many policies as possible, but you should assess your actual needs first.

It can also be beneficial to investigate coverage for a newly acquired business in case there are undisclosed issues from the seller or if you experience damage before you begin operations.

Purchasing Commercial Property Damage Insurance in Texas

Your insurance company will acquaint you with the variety of insurance coverage they offer. Some businesses choose basic form policies, covering basic damage to the buildings and property. Others will find a commercial package policy is a more effective and economical choice. Regardless of your decision, your insurance carrier should educate you on what each policy covers and what it does not.

When it comes time to make a claim, knowing the details of your coverage will be crucial. The claims process is confusing and long, and your insurance provider is counting on you not knowing insurance law the way they do. They will send insurance adjusters to assess your claim and then try to reduce what you receive. If you bought coverage that does not pay for your losses, they may say you should have been more careful.

Because the insurance provider and its adjuster are not on your side, they will sell you an insufficient policy and then refuse to honor your claim. Whether you are considering insurance, in the process of purchasing it, or have already bought it, consulting with a skilled commercial property damage insurance attorney can help you avoid making costly mistakes.

Potential Causes of Commercial Property Damage

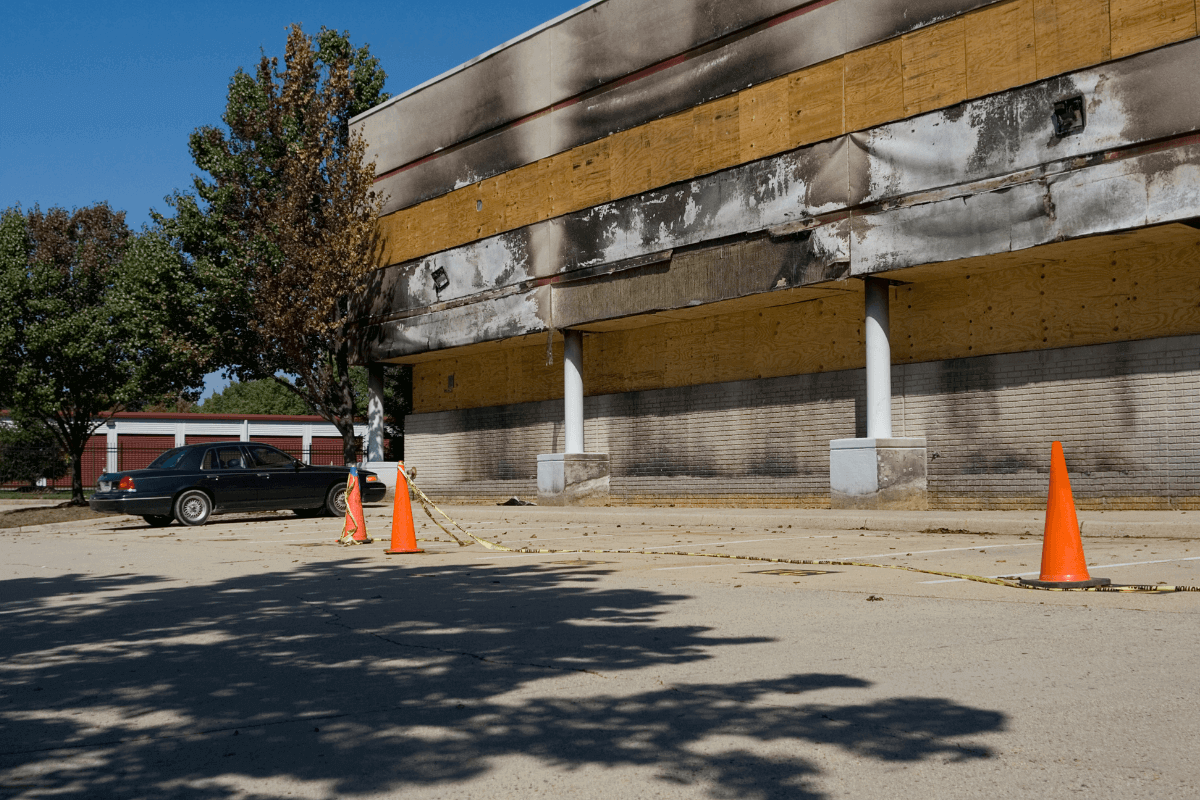

Along the coast of Texas, business owners are under threat of damage to their commercial property nearly year-round. Tornados, hurricanes, floods, and other natural disasters often cause significant damage and interruption, but human-caused events can affect your property.

Some common causes of commercial property damages include:

- Accidents

- Burst pipes

- Explosions

- Fire and smoke

- Insect and animal infestation

- Lightning strikes

- Malfunctioning appliances and equipment

- Mold

- Strong winds

- Tropical storms and hurricanes

- Vandalism and theft

Standard commercial property damage usually covers perils such as these, but others may require separate policies. Mold remediation and flood repair can be very costly, requiring extended treatment to return a building to safe conditions. Having dedicated policies for events like these can be worth it in the Gulf Coast area. In many cases, these perils are typically included in the commercial coverage that businesses purchase.

Common Damage Claims Commercial Property Owners Make

Minor damage that requires simple repair may not interrupt your operations. However, when substantial issues make it impossible to keep your doors open, you will need to include this as part of the claims process.

There are important kinds of damage claims you may make to your insurance carrier, including:

- Business interruption: Purchasing business interruption insurance can give you access to funds to keep your operations afloat when property damage affects your ability to conduct sales. Losing that income can be devastating to your company’s future.

- Equipment and machinery damage: When the machines and equipment you use daily are damaged, you will need insurance to purchase new ones or repair those that malfunction.

- Inventory loss: Theft or other causes can deplete or damage your available product inventory, taking money out of your pocket until it can be replenished. This insurance gives you financial support during this time.

- Structural damage: When a storm or other event damages your buildings so badly that they are unsafe for use, you will need immediate funds to repair load-bearing walls and replace floors or roofs.

For every claim, it is crucial that you provide as much evidence as possible to convince the insurance company that your claim is valid. They are always on the lookout for fraud and may deny your claim for any suspicion of false information.

The Role of Property Damage Lawyers in Your Commercial Insurance Claim

If you own a business, you likely have a list of trusted service and repair professionals you can call after suffering an event. Getting quotes for repairs is an essential part of filing a successful property damage claim to speed up the process and avoid future insurance disputes.

However, no matter how well you follow the rules, insurance adjusters are more interested in pocketing your premiums than honoring your need for a fair settlement. They will make a lowball offer, hoping you will take it and move on. When your insurance company is not playing fair, you need experienced commercial property damage attorneys to fight on your side.

Underpaid claims and claim denials happen more than they should, and Burnett Law Firm has the skills and background to push back to secure the payout you deserve. We will gather all relevant evidence and documentation to prove your expenses are valid and necessary, and we negotiate aggressively while you focus on your company. We work to minimize the business interruption you must face until the insurer pays.

We Help Strengthen the Validity of Your Commercial Property Damage Claim

Commercial property owners face a wide range of losses after a damaging event. Struggling to keep your doors open or to reopen quickly after repairs can be frustrating when the insurance company denies or delays your settlement. In the midst of it all, you may overlook vital expenses you can claim.

Our insurance attorneys will help you support your claim by collecting receipts and identifying costs that deserve compensation. For example, we will assess whether you are entitled to the following:

- Supplies and labor needed to make temporary repairs that prevent further damage

- Lost payroll and revenue from business interruption

- Damage to trucks, cars, boats, planes, and other vehicles used for your operations

- Destruction of fencing, landscaping, levees, and other security features

- Loss of important business documents

- Damage or theft of cash or other financial instruments

- Costs of additional construction to meet current building codes

- Funds to assist employees who lose income due to business interruption

You will also need to determine whether your policy provides coverage for replacement costs or actual cash value. Replacement coverage will repair or rebuild your property and buildings at their current costs, even if this exceeds what you originally paid. Actual cash value coverage will replace your property at its original value minus any depreciation. This is often not enough to fully restore the company.

When Bad Faith Affects Your Commercial Property Insurance Claims

While insurance providers have the right to investigate a claim before they pay a settlement, some carriers do not operate in good faith. They may delay responding to your claim, fail to provide sufficient guidance for submitting your expenses, or otherwise try to avoid paying out on your property damage insurance policy. When this happens, you need professional legal representation to hold them accountable.

Pressure to settle quickly for a small amount, as well as other underhanded tactics, could amount to bad faith practices. In cases like this, your attorney can help you file a complaint and bring a bad faith insurance lawsuit to recover damages when you are not paid for your losses. You can seek full compensation to repair your property from the following:

- Water damage

- Smoke damage

- Fire damage

- Hail damage

- Wind damage

- Natural disasters

When you engage an insurance attorney, the insurance company will recognize that you mean business. They will often settle out of court for a satisfactory amount, meaning you can repair your property and get back to work. Burnett Law Firm is dedicated to helping you get the most from your commercial property damage claim by reviewing your policy and negotiating for every penny you are owed.

Get Experienced Legal Guidance for Commercial Property Insurance Claims

When you have suffered a commercial property loss and need seasoned legal advice, contact Burnett Law Firm to schedule a free case evaluation with our commercial property damage lawyers. We proudly serve companies in Houston and across Texas when they need guidance to fight against greedy insurance carriers.

Use our convenient online form or call our offices to arrange a no-cost, no-obligation case review with an insurance claims lawyer today.